November 2019

Strategic role of government in space commercialisation

November 2019

Strategic role of government in space commercialisation

... develop products to address the needs of the government. Government strategic investment funds differ from private venture capital (VC) funds in that they focus on achieving a public policy goal - such as tailoring a technology to satisfy government...

January 2019

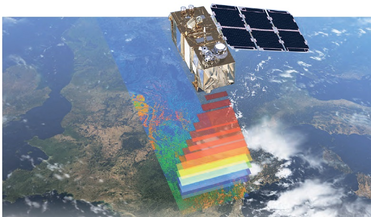

Smallsat revolution and AI kick-start nascent EO big data market

January 2019

Smallsat revolution and AI kick-start nascent EO big data market

... applications. The smallsat revolution has enabled many new players to launch new lower-cost constellations backed by venture capital. EO satellites now account for about one third of the 1,700+ operational satellites orbiting Earth. Moreover, the...

January 2020

Venture capital investment in space

January 2020

Venture capital investment in space

... directly impact yield, risks and profitability. About the author Mark Boggett is a co-founder of London based venture firm Seraphim Capital. He sits on the board of Seraphim Space Fund, Seraphim Space Camp Accelerator, UK Space Tech Angels and...

July 2020

The four horsemen of space finance

July 2020

The four horsemen of space finance

... significantly. Ten years ago, the industry struggled to attract early stage angel capital. With that problem now largely addressed, venture capital firms and other institutional investors have entered the industry in a significant way. Despite...

February 2020

Debunking the myths on space patents

February 2020

Debunking the myths on space patents

... economic deceleration. This situation created excess venture capital that eventually translated into the creation of...sense in the current NewSpace era, where the number of venture capital firms investing in space-related start-ups annually has grown ...

June 2021

China’s ascending commercial space sector

June 2021

China’s ascending commercial space sector

... motives. Most commercial companies are privately or semi-privately owned, and around half of funding comes from venture capital (VC), with the other half provided by local or provincial government. Some commercial companies are spinoffs or direct...