November 2016

Turning the Solar System into our backyard

November 2016

Turning the Solar System into our backyard

...and expand the sector’s value chain. Private venture capital investments across the space sector in 2015 alone ... the world, including Europe, a lack of opportunities for innovative ventures in commercial space is still a common perception. To begin to...

June 2017

European space business incubators and accelerators

June 2017

European space business incubators and accelerators

... clustering of young businesses fuels the growing appetite for space technology investment from business angels and venture capital funds. Well sign-posted and highly visible, they help reduce search effort for investors by creating...

April 2025

South Korea’s rising rocket star

April 2025

South Korea’s rising rocket star

... to discover that the nation is home to a commercial satellite launch vehicle company called INNOSPACE, which is entirely venture-capital funded. ROOM Editor-in-Chief Clive Simpson (right) with INNOSPACE Chief Global Business Officer, Win Marshall...

June 2017

Space economics - industry trends and space investing

June 2017

Space economics - industry trends and space investing

... and revenue could be impacted which would likely prohibit the ability to raise venture capital and without successful venture capital and other sources of growth capital such as private equity, the ability for a company to go public with an IPO...

28 November 2016

UK capital investment company initiates pioneering space technologies fund

28 November 2016

UK capital investment company initiates pioneering space technologies fund

... idea of David Williams, CEO of UK satellite operator Avanti Communications Group plc. Williams recognised the need for a venture capital fund to help boost the most innovative ‘space-tech’ companies at a time of unprecedented change within the space...

July 2020

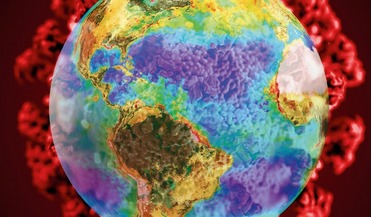

Covid-19 infects global space community

July 2020

Covid-19 infects global space community

... sustainable and profitable growth. According to PitchBook Data Inc, a research company covering the private capital markets, global venture capital investors were sitting on nearly $189 billion of cash, as of the end of June 2019. Looking ahead...