In an online article ‘The role of technology transfer post Covid-19’ published on the ROOM website in May 2020, MULTIPLY’s Natasha Allden posed a number of questions, including what if the 71 percent longtail of small and medium space businesses in the UK formally conducted business to business (B2B) technology transfer? Could it build company resilience and growth? And could it support ambitions for the economy and society? In this article she shares the global implications of two years of research into those questions, which found that investment into B2B technology transfer to and from the UK space sector can improve resilience, create sustainable growth, and have a positive societal and economic impact.

Technology transfer is about transferring technology, skills and capability into new markets and new applications, often using new business models. In the context of the space industry this is the process of transferring space know-how and technology into terrestrial business.

Technology transfer has the effect of diversifying a portfolio, spreading the risk and improving opportunities for success.

Business-to-business technology transfer is a key enabler for growth at a company and national level

Research by MULTIPLY into technology transfer in the UK space industry included unstructured observations and interviews (20 industry discussions) and a nationwide survey (65 respondents) to examine three questions with the aim of understanding the current landscape, the drivers behind technology transfers at a Space missing macrolevel and company level and the barriers to doing technology transfer to inform what we could/should be doing:

- Do you do technology transfer?

- Why do you do technology transfer?

- Why don’t you do technology transfer?

Secondary research conducted as part of the study looked broadly at the economic and societal impacts of technology transfer.

Definition

Technology transfer doesn’t have a globally accepted definition; in its broadest form it is the sharing/transfer of knowledge. More specifically it is seen as the process of transferring technology from the entity that owns it to another entity. It could be defined as: “The transfer of knowledge, processes or technology from one entity into new markets or/and new applications in return for commercial added value (i.e. revenue, market access, brand awareness and positioning)”

The value of B2B technology transfer

In the UK technology transfer from space appears to exceed a £3 to £4 return on every £1 invested. However, it is unclear if it could realise nearer £7.30 gross value added for every £1 invested by the UK government into innovation – in part due to a lack of clarity on whether technology transfer is wrapped in the innovation investment category and whether it refers to B2B, academic-to-industry transfer or both.

Despite this, the Organisation for Economic Co-operation and Development (OECD) recognises technology transfer as a propagation mechanism that can trigger innovation, directly benefitting the economy and addressing critical social challenges. It is recognised as being able to reduce costs, enhance productivity, increase portfolios of competitive products and lead to new emerging markets.

To see this in action we can turn to space policy expert, Henry R Hertzfeld, who reported in the Journal of Technology Transfer in 2002 on the value realised from NASA’s Life Sciences Technology Transfer activity. At that time NASA had invested roughly $3.7 billion in life sciences R&D in support of the successful human spaceflight programme. Using a very conservative measurement technique, Hertzfeld’s pilot study of 15 companies “found a large return to those that have successfully commercialized NASA life sciences spinoff products. Value added benefits totalled over $1.5 billion and a NASA R&D total investment in these 15 technologies of $64 million was found to stimulate an additional $200 million in private R&D.”

Internationally, technology transfer also has a role to play as a key component to productivity: “In the longterm, technology transfer is the main component of technical progress as it leads to increased productivity and helps to narrow the gap between less and more developed countries. As a result, the return rate from innovative investments is more than twice as large as those in physical capital.”

B2B space technology transfer today

MULTIPLY’s research showed awareness and effort being made toward technology transfer. However, looking more closely, formal or ‘active’ transfer (dedicated departments or programmes) was mostly found in large organisations and government agencies.

Accidental technology transfer (also referred to as ‘spill-over’) was more often the case for the remaining 71 percent of small, micro and medium enterprises in the sector that are not so well understood. The UK space industry is one of a longtail of small companies and with sector growth we can expect to see more new space companies being formed.

The survey response showed that over half (52 percent) of respondents do not do technology transfer and only 18 percent do so formally, i.e. have dedicated programmes or departments. Comparatively, survey responses including engineering companies that do not have space as their primary market, showed a higher proportion (36 percent) actively doing technology transfer.

Appetite for B2B technology transfer

In the context of the space industry this is the process of transferring space know-how and technology into terrestrial business

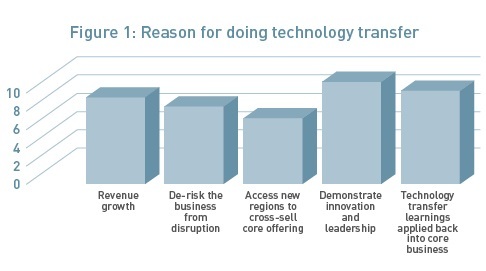

Ironically, despite 82 percent of respondents not formally participating in technology transfer, the appetite for it was high. Companies proactively doing technology transfer with a dedicated programme or department, cited demonstrating innovation and leadership as the main reason for doing so (Figure 1).

Whereas when taken in context of other companies, not wholly focussed on space, revenue generation was the most cited reason to do technology transfer.

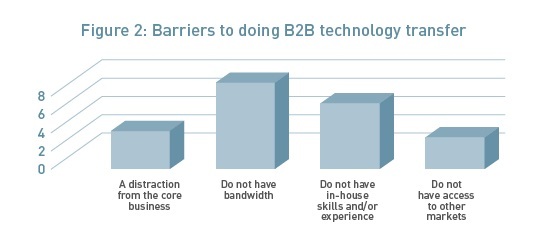

Not having the ‘bandwidth’ to undertake technology transfer activity was the main reason companies didn’t do technology transfer, with 47 percent of respondents citing this reason. Not having the in-house skills and experience or concern it would be a distraction from the core business were also highlighted (Figure 2).

Technology transfer tomorrow

Business-to-business technology transfer is a key enabler for growth at a company and national level. This study has highlighted that there are significant opportunities for B2B technology transfer activity to play a bigger role, from building sustainable industries through diversified technology transfer programmes to adding value to the economy and society as a whole, and there is the appetite to do so.

To take advantage of this opportunity, firstly, understanding B2B technology transfer in isolation outside of a broader innovation research piece is key to raising awareness and understanding. Second, mechanisms need to be provided that address the barriers to entry identified in this study.

The full study details an approach to target companies with the potential to transfer technology, de-risk them to provide confidence and build capability through the right support mechanisms including:

- Further Insight and Design – building a customer led programme of support mechanisms.

- Policy Development – collaboration between private facilitators and government to raise awareness and embed into policy.

- Financial Mechanisms – from loans to skills vouchers and grants to support companies transferring technology.

The purpose of this article, as with all questions put into the public domain, is to stimulate discussion across public and private sectors; to collaboratively build the right support, communication and access to tools to transform growth; and to further build a resilient, commercially sustainable space industry to benefit humankind here on Earth as well as in space.

The full study can be accessed at - https://multiply.space/our-work/research/

About the author

Natasha Allden founded MULTIPLY in 2015 to unleash the potential value of technology and people, maximising growth and revenue generation through technology transfer into new markets and applications. Specialising in the space sector, MULTIPLY has developed opportunities in excess of £30 million through technology transfer programmes and ventures. Having built her first company at the age of 21 Natasha went onto pursue a career in digital strategy and proposition development for FTSE100 companies in energy, finance and insurance before moving onto advanced engineering programmes in space, automotive and energy. She has an international track record leading commercial strategies, marketing and sales, development programmes and partnerships.